Janet Xuanli Liao, University of Dundee

As the world’s largest CO₂ emitter and second largest economy, China’s climate policy has faced intense scrutiny over the past decade. Despite a report from the International Renewable Energy Agency in January saying that China is set to become “the world’s renewable energy superpower”, coal is still the dominant fuel in the country’s energy mix.

According to a Greenpeace report in March, the China Electricity Council (representing the power industry) recommended that China increase its coal power capacity. While the council said this should peak by 2030 with a cap below 1,300GW, this figure is still 290GW higher than China’s current capacity and would mean building two large coal power stations a month for the next 12 years. If Beijing was to take this appeal seriously, it would certainly be incompatible with China’s pledge at the Paris COP21 to reduce carbon intensity by 60-65% from 2005 levels by 2030.

China’s climate policy over the past decade has shown rather a positive trend towards cutting CO₂ emissions and beefing up environmental protection. In addition to the 2009 Copenhagen pledge to also reduce carbon intensity by 40-45% by 2020 (which it had actually already achieved in 2017), China has been waging a “war on air pollution” since 2013, with the aim of replacing coal with natural gas in residential heating systems and in industry sectors.

In a 2016-2020 development plan for the power sector, issued in December 2016, Beijing called for a 50GW increase of gas-fired power capacity, which would bring the total to 110GW by 2020. It also said it aimed to cap coal-fired power capacity below 1,100GW, by cancelling or postponing construction on a number of projects, and increasing renewables to 15% of its energy mix by 2020.

Such an energy revolution – centred on promoting renewable power and replacing coal with gas – led to a decline of China’s CO₂ emissions between 2014-2016. In 2018, the share of coal in China’s energy mix fell below 60% for the first time in three decades, while its renewable power capacity grew 12% in 2018 from the year earlier.

Growing reliance on imported gas

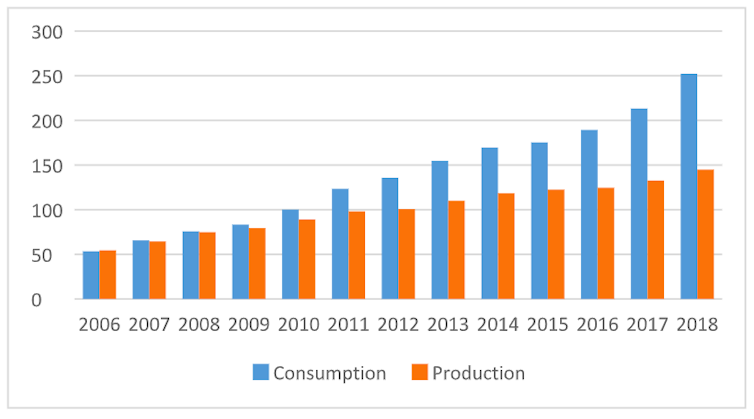

Beijing’s coal-to-gas policy, however, also triggered a soaring gas demand, which reached 283 billion cubic metres (bcm) in 2018, up 17.7% year-on-year. As a comparison, domestic gas production was only 161.5bcm in 2018. China, then, has had to increasingly rely on gas imports, hitting 121.4bcm (pipeline 47.9bcm and liquefied natural gas 73.5bcm) in 2018, up 32% from 2017.

Thanks to the shortage of natural gas supplies and a surging electricity demand, China’s coal use did show slight growth: 0.4% in 2017 and 1% in 2018, which led to a 2.3% and 1.7% rise in CO₂ emissions in 2017 and 2018, respectively.

China’s growing reliance on gas imports involves risks to the reliability of supply. In November 2017, for example, there was a disruption of pipeline gas from Central Asia, which led to northern China facing a gas shortage that took liquefied natural gas prices to the highest level since December 2014 and 20% higher than a year before.

The higher prices of natural gas have also affected the development of China’s gas-fired power capacity, as has its electricity pricing system, which has led experts to appeal for urgent reforms if China’s gas-for-coal scheme is to succeed.

Industrial-scale power

Against a slower than expected growth in gas-fired power capacity, and a 8.5% growth in electricity demand in 2018 from an upturn in the steel and cement industries, the power sector has contributed the most to the rise of China’s coal use, accounting for 4.9% and 6.4% of the growth in 2017 and 2018, respectively, against a 1% and 0.4% increase in total.

That being said, there is no sign of a change in China’s position on climate change and environmental protection. In March 2019, Liu Youbin, a spokesman for China’s Ministry of Ecology and Environment, said that “reducing carbon emissions is not only what the world wants China to do but also an inherent requirement for China’s sustainable development”. Energy experts in China also see little chance that the proposal by the China Electricity Council – being viewed as an appeal from the coal industry that is not shared by the Chinese public – would be approved by central government.

It is unrealistic to expect China to remove coal from its energy mix completely in the near future. What China has done too is to install new emissions control technology at its coal-fired power plants. According to China’s environment minister, Li Ganjie, around 810GW (80%) of China’s coal-fired capacity was employing this “ultra-low emission” technology by the end of 2018.

China’s journey of moving away from coal may seem slower than some expect, but it is already employing technologies to curtail CO₂ emissions before it is able to get rid of coal completely. In the meantime, Beijing has persistently shown its commitments to a low-carbon path of development, by accelerating the process of cutting coal use via energy efficiency enhancement, shifting the economy from manufacturing to services, and renewable development.

Janet Xuanli Liao, Senior Lecturer in International Relations and Energy Security Studies, University of Dundee

This article is republished from The Conversation under a Creative Commons license. Read the original article.