BY Antoine Bouët, David Laborde, and Fousseini Traoré

Food security in West Africa has been deteriorating since 2015: The proportion of the population affected by undernutrition rose from 11.5% in 2015 to 18.7% in 2020, a total of 75.2 million people. Now, like the rest of the world, the region faces rapidly growing impacts from Russia’s war in Ukraine, including spiking food prices and disruptions in markets for cereals and other commodities, including fertilizers and fuels. What are some of the war’s likely effects on West Africa?

Overall, the greatest risk is from rising global prices. The region imports relatively little food or fertilizer (with some exceptions) from Russia and Ukraine, insulating it from many of the current market disruptions, and has capacity to substitute some lost fertilizer imports.

Commodity markets in turmoil

In February 2022, before the conflict began, the FAO food price index had already reached an all-time high of 140.7 due to rising prices for vegetable oils, dairy products, and grains. Now, prices are spiking still higher as Russia and Ukraine account for a major share of the world’s cereal exports, particularly wheat, and the conflict disrupts markets for fuels and other commodities. International fertilizer prices, for instance, have risen sharply: the price of urea, for example, doubled in Feb. 2022 compared to its 2015-2019 average.1

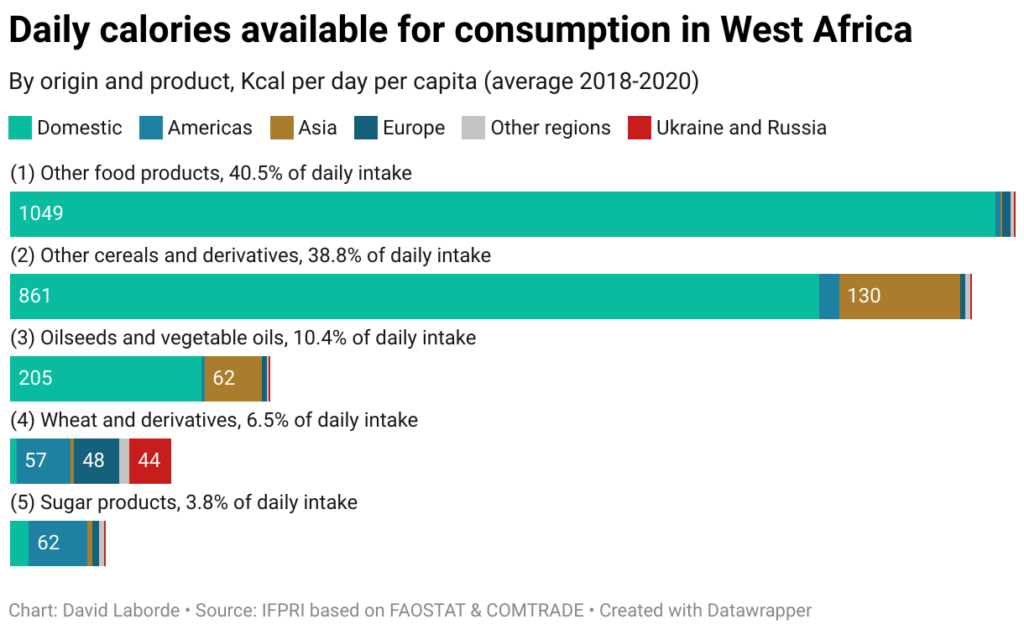

The good news for West Africa is that it trades little with Russia and Ukraine, except for Benin’s exports to Ukraine (4.7% of its total exports) and Benin and Senegal’s imports from Russia (between 4% and 5% of total imports, respectively). In terms of food security, the caloric contribution of these trade relationships is relatively small (Figure 1). Most of the calories consumed in the region come from local production, Europe, and Asia. Ukraine and Russia are significant suppliers of calories to West Africans only through trade in wheat (1.7% of total calories consumed). Ukraine’s contribution is marginal, Russia’s is more important.

Figure 1

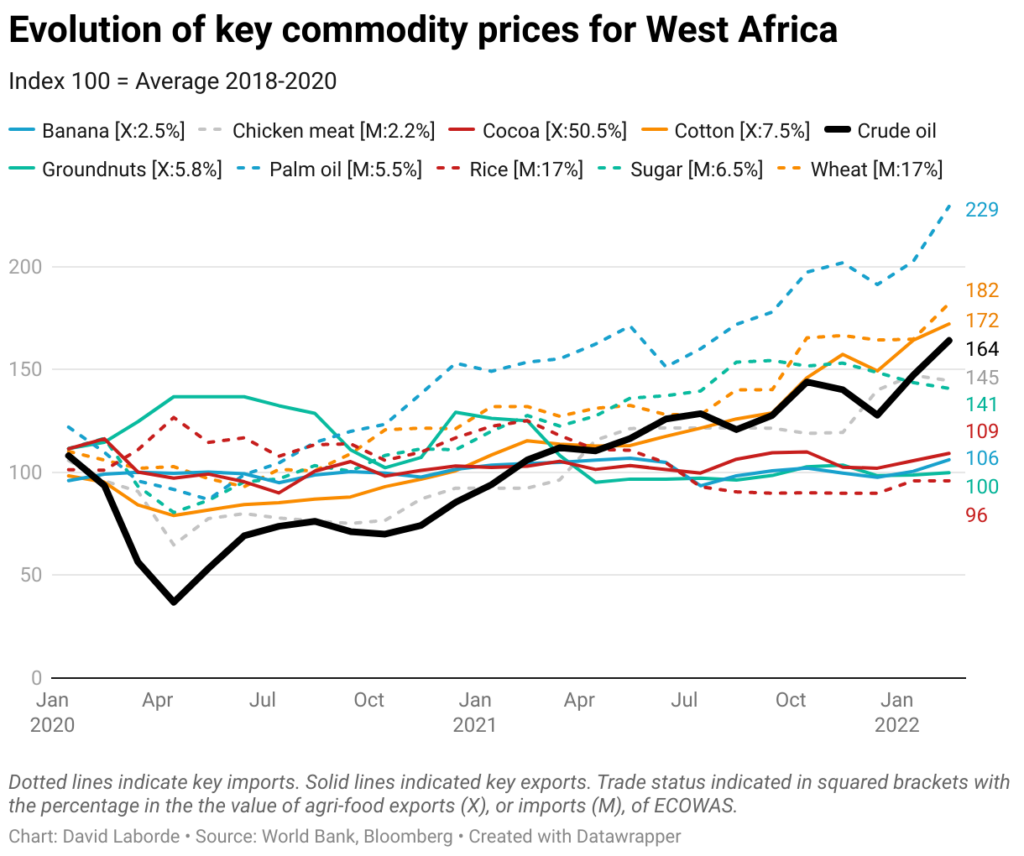

The greatest challenge for West Africa is likely to be indirect effects of higher world prices (Figure 2). Before the Russia-Ukraine conflict, West Africa was seeing an economic recovery from impacts of the COVID-19 pandemic; the region’s GDP per capita at constant prices had previously fallen by 1% in 2020, according to the International Monetary Fund (IMF). Now, rising prices threaten that recovery.

Indeed, West Africa is an importer of cereals, sugar, vegetable oils, meat, and animals, and an exporter of cocoa, cotton, peanuts, fish, and fruits. Figure 2 shows increases in the price of palm oil, sugar, wheat, and chicken meat from Jan. 2020-Feb. 2022, while the prices of bananas, cocoa, and groundnuts are stable. The only good news on the agricultural side is that the price of rice (imported) is stable (though international price volatility has recently increased), and the price of cotton (exported) has increased.

Meanwhile, outside of agriculture, commodity price developments are positive for the region, as it is also an exporter of certain raw materials: Gold, tin, oil (which alone accounts for more than half of the region’s export earnings), copper, natural gas, uranium, zinc, and aluminum.

Figure 2

Of course, the impacts on local populations of these various market shifts will depend to some degree on government policies. Increases in agricultural and food prices can only be compensated for by increases in commodity prices if there are redistribution mechanisms that allow for this compensation: For example, by taking revenues from mining rents to finance food subsidies or other forms of support. Price increases also pose a particular problem for urban households, which are more dependent on imports, such as wheat.

Fertilizers matter

The cessation or reduction of fertilizer imports from Russia—the Economic Community of West African States’ (ECOWAS) second largest supplier with 12% of the market—is also a serious risk for West African farmers. But it is also an opportunity for regional suppliers.

First and foremost, Nigeria has the capacity to substitute for the missing imports. The country has seen heavy investment in the fertilizer sector through Indorama Nigeria and the Dangote Group, taking advantage of its sizable natural gas reserves. In addition, Morocco, which supplies one third of the ECOWAS fertilizer market, recently invested $1 billion in Nigeria to build two phosphate plants (capacity of 1 million tons each). If we take the seven major West African countries, excluding Nigeria, for which data is available (Burkina Faso, Côte d’Ivoire, Ghana, Mali, Niger, Senegal, Togo), their fertilizer imports from Russia total only about 0.24 million tons. Nigeria could therefore remedy this imbalance: Dangote has a capacity of 3 million tons, Indorama 1.4 million, and Nigerian consumption is only 1.5 million tons.

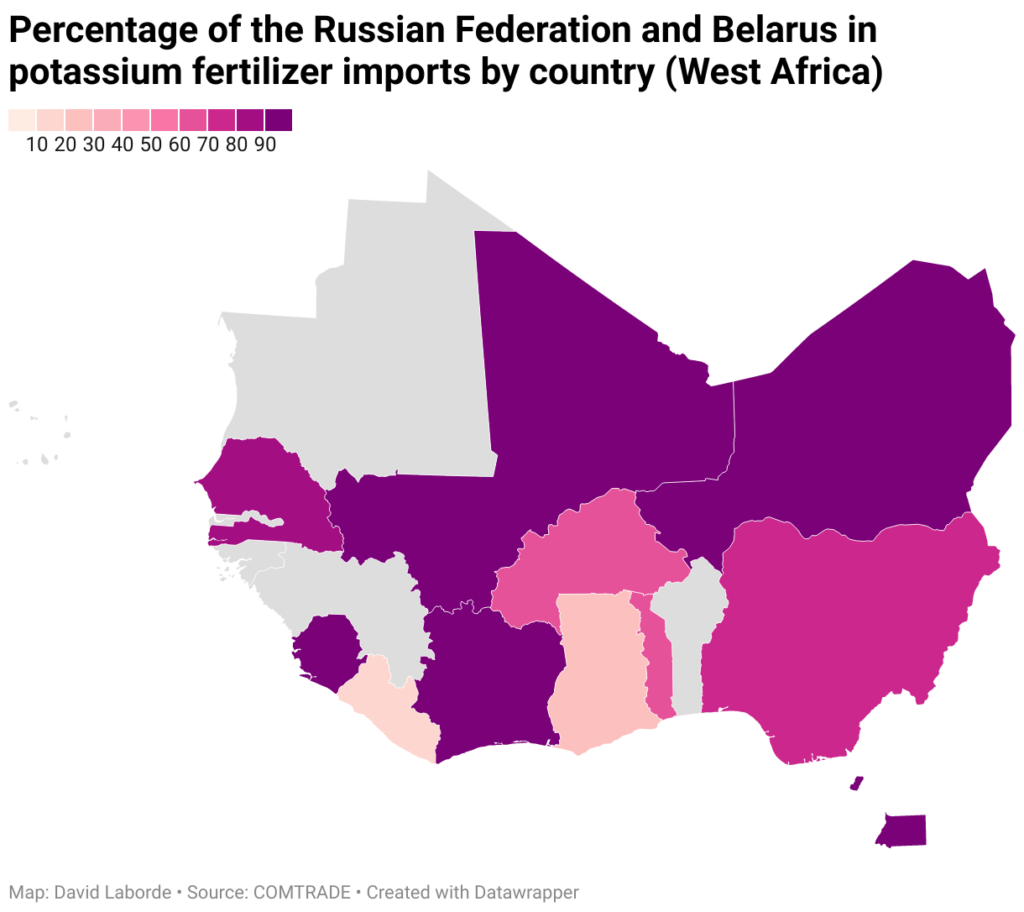

However, difficulties arise for other types of fertilizers. West Africa imports 82% of its potassium consumption, and for Côte d’Ivoire, Mali, Niger, Senegal, and Sierra Leone, the vast majority of imports—80%—come from Belarus and Russia (Figure 3).

Figure 3

Finally, farmers‘ access to fertilizer varies greatly from country to country. In some countries, only market mechanisms play a role, and price increases should be felt entirely by farmers. In others, the cost is largely borne by public budgets through state subsidy programs (Nigeria, Ghana, Togo).

An initial context of food inflation and political conflict

Economic impacts of the Russia-Ukraine crisis are also intersecting those surrounding the 2021 coup in Mali. In response, ECOWAS has twice imposed an embargo on the country, effectively closing its borders to all member states, except for trade in basic necessities. Malian authorities have twice taken retaliatory measures. Some Malian sectors, such as livestock and meat, had already prohibited their members from exporting within ECOWAS. As Mali is one of the region’s main suppliers of livestock, the suspension of Malian exports has created market tensions—particularly in the meat sector—in some countries. Since the latest retaliation, the price of meat has risen by 25%-30% in Dakar, Senegal.

The economic fallout from regional tensions in West Africa and the Russia-Ukraine situation illustrates the dangerous links between diplomatic sanctions, trade, and food security. These situations continue to play out. Mali is contesting the legality of the embargo under EU law and the United Nations Convention on Trade in Landlocked Countries. The current situation presents a challenge for ECOWAS, which should refrain from taking measures that could worsen regional food security, already greatly aggravated by the COVID-19 crisis. Intra-ECOWAS trade of agricultural and food products should be facilitated and not restricted by measures like export restrictions or embargos; regarding the rest of the world, a reduction of the common external tariff, already low on food products, should be considered, as well as redistributive measures to support poor households.

Antoine Bouët and David Laborde are Senior Research Fellows with IFPRI’s Markets, Trade and Institutions Division (MTID); Fousseini Traoré is an MTID Research Fellow.

This article is republished from International Food Policy Research Institute (IFPRI) under a Creative Commons license. Read the original article.

1. Source : IFDC, Derived from AfricaFertilizer.org data